Going into 2023, there was a lot of talk about a possible recession that would cause the housing market to crash. Some in the media were even forecasting home prices would drop by as much as 10-20%—and that might have made you feel a bit unsure about buying a home.

But here’s what actually happened: home prices went up more than usual. Brian D. Luke, Head of Commodities at S&P Dow Jones Indices, explains:

“Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years.”

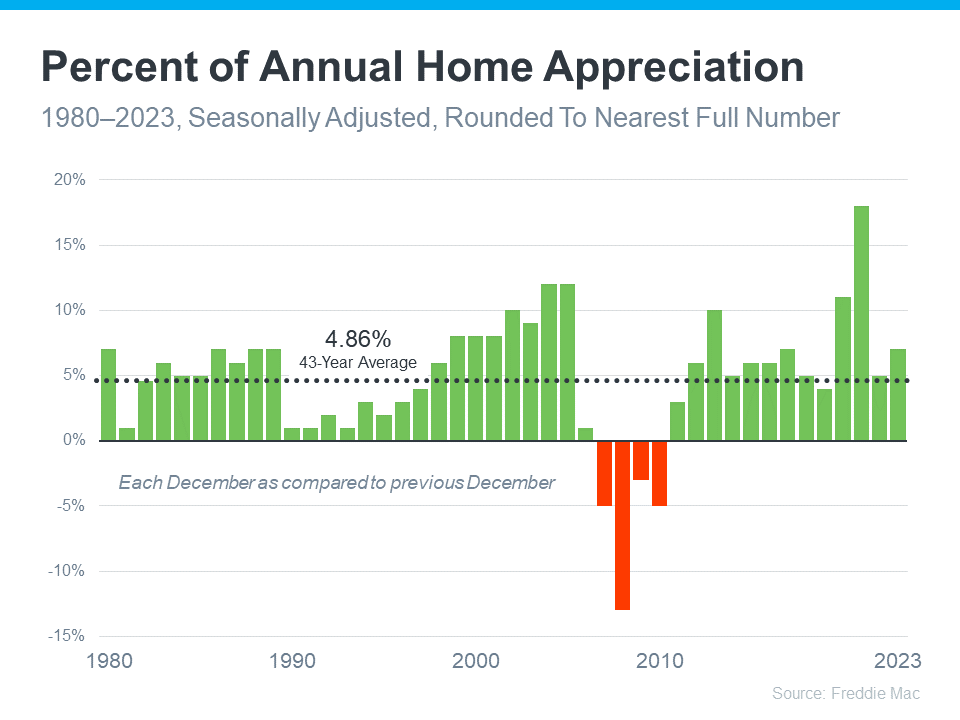

To put last year’s growth into context, the graph below uses data from Freddie Mac on how home prices have changed each year going back to 1980. The dotted line shows the long-term average for appreciation:

The big takeaway? Home prices almost always go up.

As an article from Forbes says:

“. . . the U.S. real estate market has a long and reliable history of increasing in value over time.”

In fact, since 1980, the only time home prices dropped was during the housing market crash (shown in red in the graph above). Fortunately, the market today isn’t like it was in 2008. For starters, there aren’t enough available homes to meet buyer demand right now. On top of that, homeowners have a tremendous amount of equity, so they’re on much stronger footing than they were back then. That means there won’t be a wave of foreclosures that causes prices to fall.

The fact that home values went up every single year except those four in red is why owning a home can be one of the smartest moves you can make. When you’re a homeowner, you own something that typically becomes more valuable over time. And as your home’s value appreciates, your net worth grows.

So, if you’re financially stable and prepared for the costs and expenses of homeownership, buying a home might make a lot of sense for you.

Bottom Line

It’s evident that your home represents far more than just a place to live—it’s a powerful investment that can significantly impact your financial well-being and overall quality of life. Throughout this exploration, we’ve delved into various aspects of homeownership, from building equity and enjoying tax benefits to leveraging your property for additional income.

One key takeaway is the importance of understanding the broader context of the real estate market and economic trends when making decisions about buying or selling a home. By staying informed and working with knowledgeable professionals, you can make strategic choices that align with your long-term goals and maximize the potential returns on your investment.

Furthermore, we’ve highlighted the transformative potential of homeownership in shaping communities, fostering stability, and providing a sense of pride and belonging. As homeowners, we have the opportunity to create spaces that reflect our values, support our lifestyles, and contribute positively to the neighborhoods we inhabit.

It’s also crucial to recognize that homeownership comes with responsibilities and challenges, from managing maintenance and repairs to navigating fluctuations in the housing market. However, with proper planning, financial discipline, and a proactive approach, these obstacles can be overcome, allowing you to reap the rewards of homeownership for years to come.

Ultimately, your home is not just a financial asset—it’s a place where memories are made, relationships are nurtured, and dreams are realized. By viewing your home as a powerful investment and treating it with care and consideration, you can unlock its full potential and create a foundation for a brighter future.

Home prices almost always go up over time. That makes buying a home a smart move, if you’re ready and able. Let’s connect to talk about your goals and what’s available in our area.

EN

EN

ES

ES