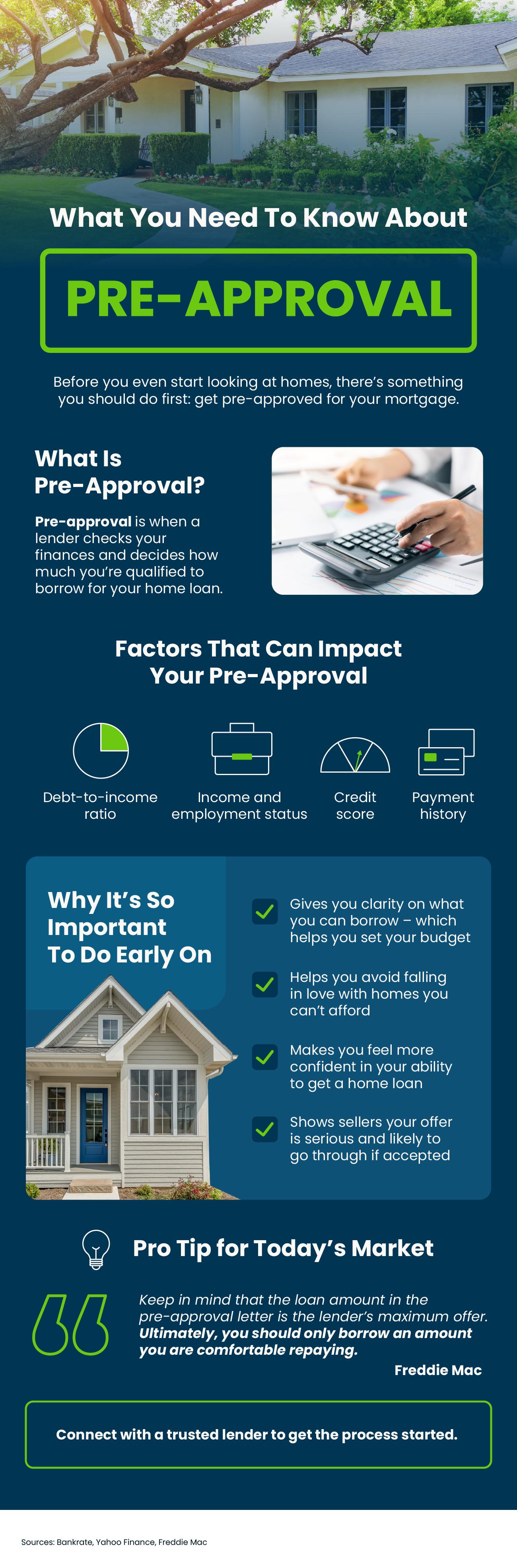

What You Should Know About Pre-Approval

Purchasing a home is one of the most important financial choices you will ever make, and obtaining mortgage pre-approval is a key step in this journey. Whether you’re a first-time buyer or a seasoned homeowner, grasping the concept of pre-approval and its advantages can significantly impact your experience.

What is Pre-Approval?

Pre-approval is a lender’s assurance that you qualify for a home loan, following a comprehensive assessment of your credit history, income, assets, and debt-to-income ratio. Unlike pre-qualification, which merely offers a rough estimate of your loan eligibility, pre-approval provides a conditional commitment from a lender, offering a clearer view of your purchasing capacity.

Why is Pre-Approval Important?

Establishes Your Budget

A pre-approval gives you a precise understanding of what you can afford for a home, preventing the disappointment of falling for a property that exceeds your financial means.

Enhances Your Offer

In a competitive housing market, sellers favor offers from pre-approved buyers, as it demonstrates your financial readiness to proceed. Having a pre-approval letter can give you a competitive edge over other potential buyers.

Accelerates the Loan Process

Because much of the financial assessment is completed during the pre-approval stage, the final loan approval can progress more swiftly once you identify a home and submit an offer.

Reveals Potential Credit or Financial Concerns

During pre-approval, your lender will examine your credit score, outstanding debts, and financial background. If any issues surface, you’ll have the opportunity to resolve them before making an offer on a property.

How to Get Pre-Approved

Collect Your Financial Documents

To apply for pre-approval, you’ll need to provide your lender with important documents, including:

✅ Proof of Income – Recent pay stubs, tax returns, or profit and loss statements (if self-employed).

✅ Proof of Assets – Bank statements and investment account summaries.

✅ Employment Verification – Lenders may reach out to your employer to confirm job stability.

✅ Credit Report – A strong credit score can enhance your loan terms and interest rate.

✅ Debt-to-Income Ratio – Your lender will evaluate your existing debts to determine your affordability.

Select a Lender

It’s wise to compare various lenders to secure the best mortgage rates and terms. Many banks, credit unions, and mortgage brokers offer pre-approval services.

Submit Your Application

After choosing a lender, send your financial documents and application. The lender will assess your information and provide a pre-approval letter, typically valid for 60-90 days.

What to Do After Getting Pre-Approved

Stick to Your Budget: Just because you’re pre-approved for a certain amount doesn’t mean you should spend every penny.

Avoid Major Financial Changes: Refrain from opening new credit accounts, accruing large debts, or making significant purchases before finalizing the home deal.

Begin House Hunting: Armed with a pre-approval letter, you can confidently start exploring homes within your budget.

Final Thoughts

Obtaining pre-approval is a vital step in the home-buying process. It not only clarifies your budget but also positions you as a stronger, more appealing buyer. If you’re ready to embark on your home search, let’s connect to explore your options!

📞 Reach out to Randy & Kelly Becker at 602.910.7595 to get started!

EN

EN

ES

ES