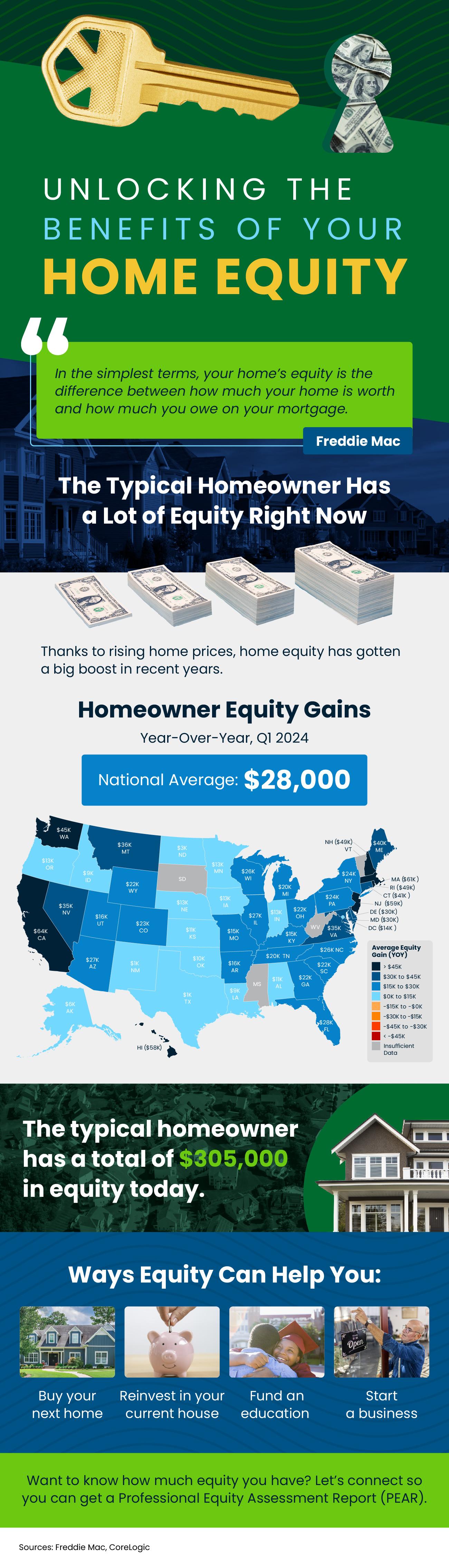

Understanding Home Equity

Home equity is calculated by subtracting the amount you owe on your mortgage from the current market value of your home. For example, if your home is worth $300,000 and you owe $150,000 on your mortgage, you have $150,000 in equity. This equity can be a powerful tool for achieving various financial goals.

Home Equity Loans and Lines of Credit

One of the most common ways to access your home’s equity is through a home equity loan or a home equity line of credit (HELOC). Both options allow you to borrow against your home’s value but differ in structure:

- Home Equity Loan: This is a lump sum loan that you repay over a fixed term with a fixed interest rate. It’s ideal for significant expenses like home renovations, debt consolidation, or major purchases.

- Home Equity Line of Credit (HELOC): A HELOC works like a credit card. You have a revolving line of credit with a variable interest rate and can borrow as needed up to a certain limit. This flexibility makes it suitable for ongoing expenses or emergency funds.

Benefits of Using Home Equity

- Lower Interest Rates: Home equity loans and HELOCs typically offer lower interest rates compared to personal loans or credit cards. This is because they are secured by your home, reducing the lender’s risk.

- Tax Deductions: Interest paid on home equity loans or HELOCs may be tax-deductible, provided the funds are used for home improvements. Consult a tax advisor to understand the specifics and eligibility.

- Debt Consolidation: High-interest debts, such as credit card balances, can be consolidated into a home equity loan with a lower interest rate, simplifying your finances and reducing overall interest payments.

- Home Improvements: Investing in home improvements can increase your home’s value, enhancing your living space and potentially boosting your equity even further.

- Emergency Funds: Accessing home equity provides a safety net for unexpected expenses, such as medical emergencies or significant repairs.

Risks to Consider

While leveraging home equity offers numerous advantages, it’s essential to be aware of the risks involved:

- Risk of Foreclosure: Since home equity loans and HELOCs are secured by your home, failure to repay can result in foreclosure. It’s crucial to ensure you can meet the repayment terms.

- Variable Interest Rates: HELOCs typically come with variable interest rates, which can rise over time, increasing your repayment costs.

- Market Fluctuations: A decline in property values can reduce your home equity, potentially leaving you owing more than your home is worth.

- Additional Debt: Borrowing against your home’s equity increases your overall debt. It’s important to use the funds wisely and avoid overextending yourself financially.

How to Maximize Home Equity Benefits

To make the most of your home equity, consider the following strategies:

- Regularly Monitor Your Home’s Value: Stay informed about local real estate market trends to understand your home’s current value and how it impacts your equity.

- Make Smart Renovations: Focus on home improvements that add significant value, such as kitchen remodels, bathroom upgrades, and energy-efficient installations.

- Maintain Financial Discipline: Use home equity loans or HELOCs for strategic purposes, such as debt consolidation or value-adding investments, rather than non-essential spending.

- Consult Professionals: Work with financial advisors, tax consultants, and real estate professionals to make informed decisions about leveraging your home’s equity.

BOTTOM LINE

Unlocking the benefits of your home’s equity can be a smart financial move when done thoughtfully and strategically. By understanding how to access and use your home equity, you can achieve various financial goals, from improving your property to consolidating debt and preparing for emergencies. However, it’s crucial to be aware of the risks and manage your finances responsibly to ensure you maximize the benefits while protecting your most valuable asset: your home. Let’s connect!

EN

EN

ES

ES