Homeownership is often seen as a cornerstone of the American Dream, and for good reason. Beyond providing a place to live, owning a home is one of the most effective ways to build wealth and secure financial stability over time. Here’s a closer look at the wealth-building power of homeownership and why it remains a smart financial move for many individuals and families.

Building Equity

One of the primary financial benefits of homeownership is the ability to build equity. Equity is the difference between what you owe on your mortgage and the current market value of your home. As you make mortgage payments, the amount of debt you owe decreases, and if property values increase, your equity grows even more. Unlike renting, where monthly payments only benefit the landlord, owning a home means that each mortgage payment is an investment in your own asset.

Appreciation

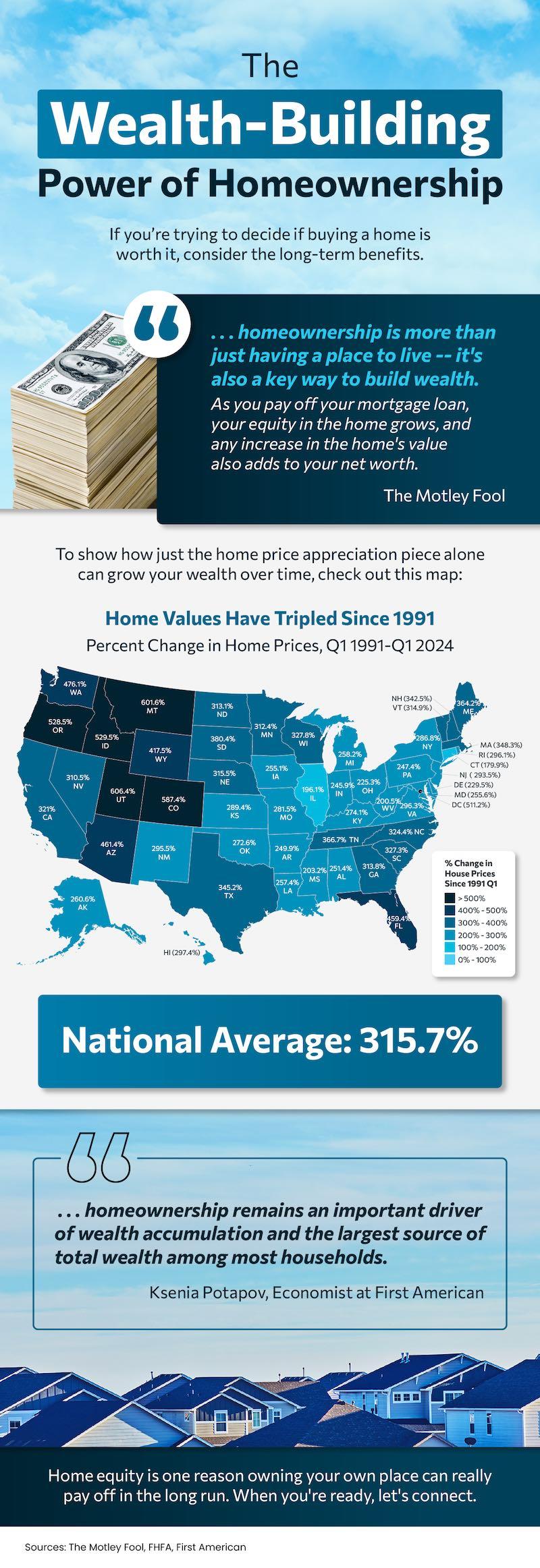

Historically, real estate has appreciated over time. While there can be fluctuations in the housing market, the general long-term trend is upward. According to the National Association of Realtors, the median home price in the U.S. has increased by an average of 5.4% annually over the past 50 years . This appreciation can significantly enhance the value of your investment, providing a substantial return when you decide to sell.

Tax Benefits

Homeowners often benefit from several tax advantages. Mortgage interest and property taxes are typically deductible, which can reduce your taxable income and, consequently, your tax bill. This makes homeownership more affordable and provides an added financial incentive. Additionally, when you sell your primary residence, you may be able to exclude up to $250,000 ($500,000 for married couples) of the capital gains from your taxable income, provided you meet certain conditions .

Forced Savings

Paying a mortgage is a form of forced savings. Unlike rent, where the money spent is gone forever, mortgage payments contribute to your equity in the home. This forced savings can be a significant wealth-building tool, especially for individuals who might otherwise struggle to save consistently.

Stability and Predictability

Owning a home can provide financial stability. With a fixed-rate mortgage, your principal and interest payments remain constant over the life of the loan, protecting you from the rising costs of rent. This predictability allows for better long-term financial planning and security.

Leveraging Home Equity

Homeowners can leverage their home equity through home equity loans or lines of credit for major expenses, such as home improvements, education, or starting a business. This access to capital can be a powerful tool for building further wealth or managing financial needs without resorting to high-interest debt.

Community and Social Benefits

Beyond the direct financial advantages, homeownership also contributes to personal wealth by fostering community stability and social benefits. Homeowners are more likely to maintain and improve their properties, contributing to neighborhood vitality and increasing property values. Additionally, studies have shown that homeownership correlates with better health, educational outcomes, and civic participation .

BOTTOM LINE

Homeownership remains a powerful tool for building wealth and achieving financial security. By providing equity, appreciation, tax benefits, and stability, owning a home offers significant advantages over renting. While it requires a substantial initial investment and ongoing responsibility, the long-term financial rewards make it a worthwhile endeavor for many people. If you’re in a position to buy a home, consider it not just a place to live, but a key investment in your financial future. Let’s connect!

EN

EN

ES

ES