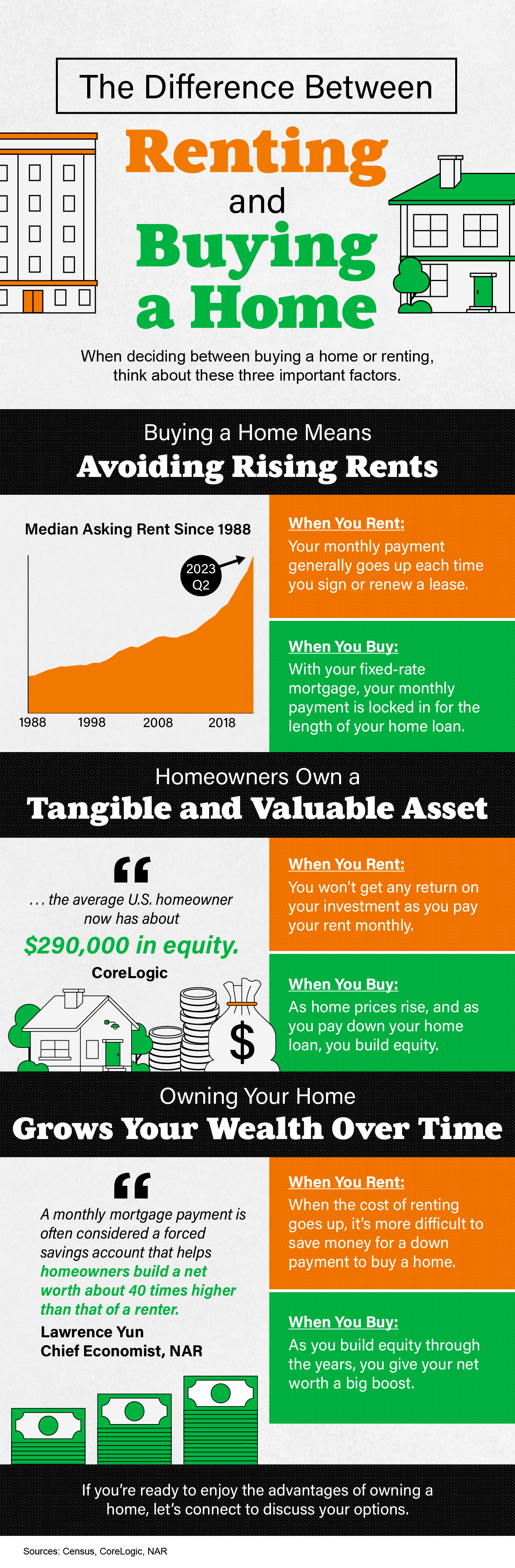

The Difference Between Renting and Buying a Home

Renting:

Renting a home offers flexibility and simplicity. Here are some of the key benefits of renting:

No Long-Term Commitment: Renters enjoy the flexibility to move when their lease expires. This is ideal for those who have uncertain job prospects or prefer to explore different neighborhoods or cities.

Lower Upfront Costs: Renters typically have lower initial costs, as they don’t need to make a down payment or cover the full cost of repairs and maintenance.

Predictable Expenses: Renters often pay a fixed monthly rent that includes most utilities. This predictability can help with budgeting.

Less Responsibility: Repairs and maintenance are generally the responsibility of the landlord. This reduces the stress of homeownership.

Amenities: Many rental properties come with amenities like gyms, pools, and communal spaces, providing a comfortable lifestyle.

However, there are some drawbacks to renting:

No Equity Building: Rent payments don’t contribute to building equity. Renters don’t benefit from the potential appreciation in property value.

Limited Control: Renters may have restrictions on decorating or renovating their space. They also rely on the landlord for maintenance and repairs.

Rent Increases: Rents can increase over time, making long-term budgeting challenging.

Buying:

Homeownership is often seen as a path to financial stability and independence. Here are some of the key advantages of buying a home:

Building Equity: Each mortgage payment helps build equity in the property. Over time, this can result in substantial wealth.

Stability: Homeowners have control over their property and can make it their own. They don’t have to worry about rent increases or sudden eviction.

Tax Benefits: Homeowners can often deduct mortgage interest and property taxes on their annual tax returns.

Investment Potential: Real estate can appreciate over time, offering potential for financial gain when it comes time to sell.

However, homeownership also has its challenges:

Upfront Costs: Homebuyers typically need a significant down payment, and they are responsible for ongoing maintenance and repair expenses.

Less Flexibility: Selling a home can be a complex process, and it may take time to find a buyer. This means less flexibility compared to renting.

Market Risks: Property values can fluctuate. While they may appreciate, there is also the risk of depreciation.

Financial Responsibility: Homeowners must manage their mortgage, property taxes, insurance, and utility costs, which can be a financial burden.

BOTTOM LINE:

the decision between renting and buying a home depends on individual circumstances and priorities. Renting offers flexibility and lower initial costs, while homeownership can lead to equity building and long-term financial stability. It’s essential to consider your financial situation, long-term goals, and personal preferences when making this important decision. Ultimately, the right choice is the one that aligns with your lifestyle and helps you achieve your financial objectives.

EN

EN

ES

ES