If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you.

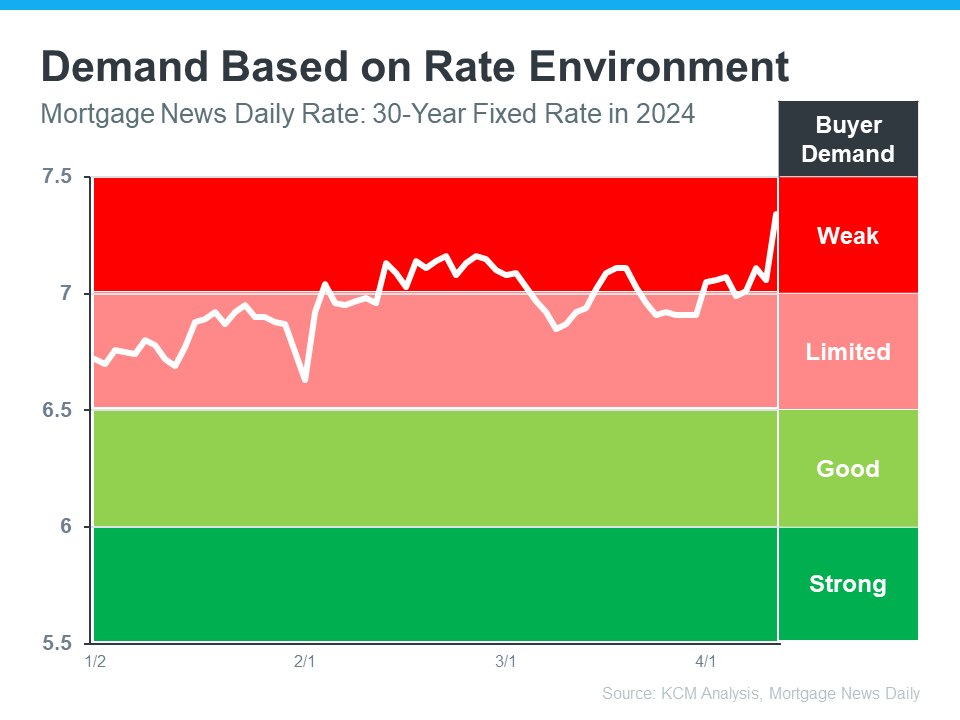

In the housing market, there’s a longstanding relationship between mortgage rates and buyer demand. Typically, the higher rates are, you’ll see lower buyer demand. That’s because some people who want to move will be hesitant to take on a higher mortgage rate for their next home. So, they decide to wait it out and put their plans on hold.

But when rates start to come down, things change. It goes from limited or weak demand to good or strong demand. That’s because a big portion of the buyers who sat on the sidelines when rates were higher are going to jump back in and make their moves happen. The graph below helps give you a visual of how this relationship works and where we are today:

As Lisa Sturtevant, Chief Economist for Bright MLS, explains:

“The higher rates we’re seeing now [are likely] going to lead more prospective buyers to sit out the market and wait for rates to come down.”

Why You Might Not Want To Wait

If you’re asking yourself: what does this mean for my move? Here’s the golden nugget. According to experts, mortgage rates are still projected to come down this year, just a bit later than they originally thought.

When rates come down, more people are going to get back into the market. And that means you’ll have a lot more competition from other buyers when you go to purchase your next home. That may make your move more stressful if you wait because greater demand could lead to an increase in multiple offer scenarios and prices rising faster.

But if you’re ready and able to sell now, it may be worth it to get ahead of that. You have the chance to move before the competition increases.

Bottom Line

The decision of whether to wait for mortgage rates to come down before moving depends on various factors, including personal financial circumstances, housing market conditions, and long-term goals. While lower mortgage rates can result in potential savings on monthly payments, waiting indefinitely for rates to drop significantly is not always practical or feasible. It’s essential to weigh the potential benefits of lower rates against other considerations, such as rising home prices, changing economic conditions, and the opportunity cost of delaying your move. Additionally, keep in mind that mortgage rates are influenced by numerous factors beyond your control, making it challenging to predict future rate movements accurately. Ultimately, consulting with a financial advisor or mortgage professional can help you make an informed decision based on your individual situation and objectives, ensuring that you’re well-prepared to navigate the complexities of the housing market. let’s chat.