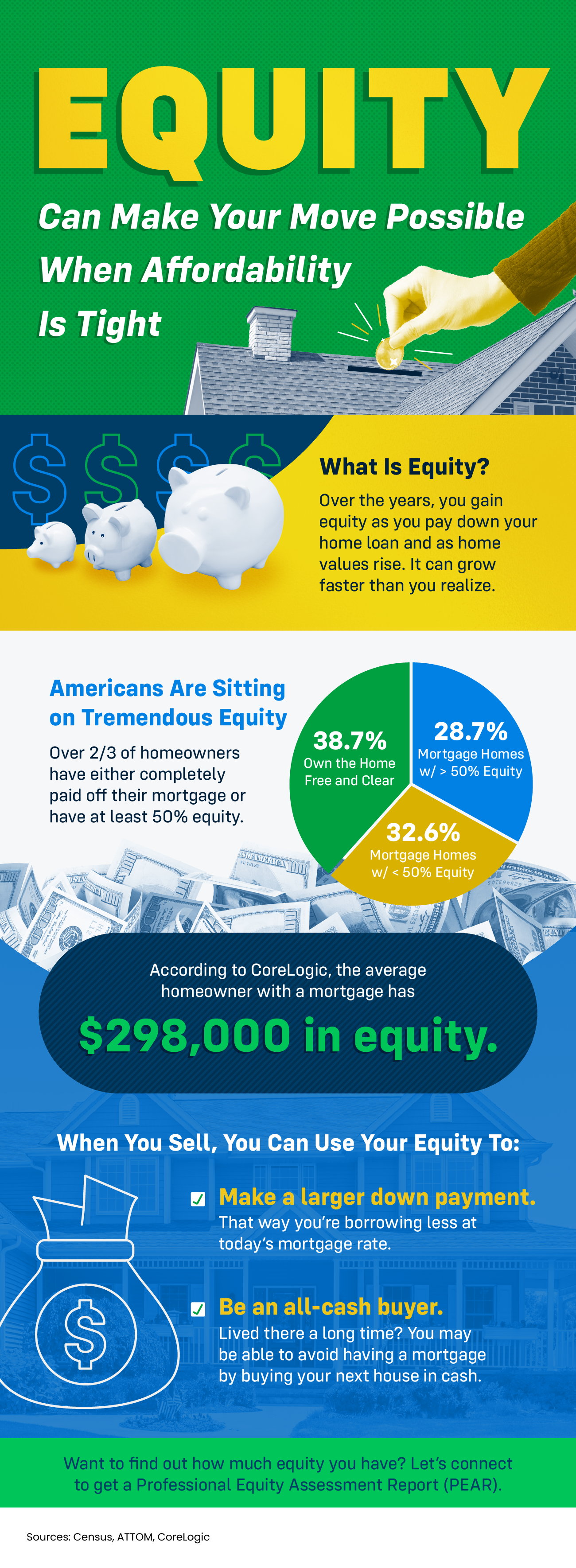

In the ever-evolving landscape of real estate, the dream of homeownership can sometimes feel out of reach, especially in markets where affordability is a concern. However, for many homeowners, there exists a valuable asset that can make the seemingly impossible, possible: equity.

Equity, simply put, is the difference between the market value of a property and the outstanding balance on any loans secured by the property. As homeowners make mortgage payments over time and the value of their property appreciates, their equity grows. This equity can serve as a powerful resource, particularly when seeking to make a move in a tight affordability market.

One of the primary ways equity can facilitate a move in a challenging affordability climate is through leveraging it as a down payment on a new home. Let’s explore how this works.

Suppose you’ve been diligently paying down your mortgage for several years, and as a result, you’ve built up a significant amount of equity in your current home. When you decide it’s time to move to a new property, you can potentially use that equity as a down payment, thereby reducing the amount of financing you need for your next purchase.

For example, let’s say your current home is valued at $300,000, and you owe $200,000 on your mortgage. This means you have $100,000 in equity. If you’re eyeing a new home priced at $400,000, instead of needing to come up with a full $80,000 (assuming a 20% down payment), you can use your existing equity to cover a significant portion of it. This not only lowers the amount of cash you need upfront but may also help you secure more favorable financing terms.

Moreover, leveraging equity can open doors to a wider range of housing options. In competitive markets where affordable properties are scarce, having a larger down payment can make your offer more attractive to sellers. It may even give you an edge in negotiations, potentially allowing you to secure a better deal on your new home.

It’s important to note that tapping into your home equity requires careful consideration and planning. While it can be a valuable tool for making a move in a tight affordability market, it’s essential to weigh the potential benefits against the associated risks.

For instance, using your equity as a down payment means you’ll have less equity remaining in your current home. This could impact your financial stability and future borrowing capacity. Additionally, if your new home purchase doesn’t appreciate as expected or if market conditions change, you could find yourself in a financially precarious situation.

BOTTOM LINE

Equity can indeed make your move possible when affordability is tight. By leveraging the equity you’ve built in your current home, you can potentially secure a larger down payment, gain access to a broader range of housing options, and improve your overall financial position. However, it’s crucial to approach this strategy thoughtfully and seek guidance from real estate and financial professionals to ensure it aligns with your long-term goals and financial well-being. Let’s connect!!

EN

EN

ES

ES