A Recession Doesn’t Mean a Housing Crisis

Economic headlines can stir uncertainty, especially when the word “recession” comes into play. Many homeowners and potential buyers immediately associate a recession with a housing crisis, largely due to the memory of the 2008 financial downturn. However, it’s important to understand that not all recessions are created equal—and a slowing economy does not automatically signal trouble for the housing market.

Recessions Are Economic, Not Always Housing Related

By definition, a recession is a period of temporary economic decline, typically identified by two consecutive quarters of negative GDP growth. While recessions can affect jobs, consumer confidence, and spending habits, they don’t always impact the housing market in the same way.

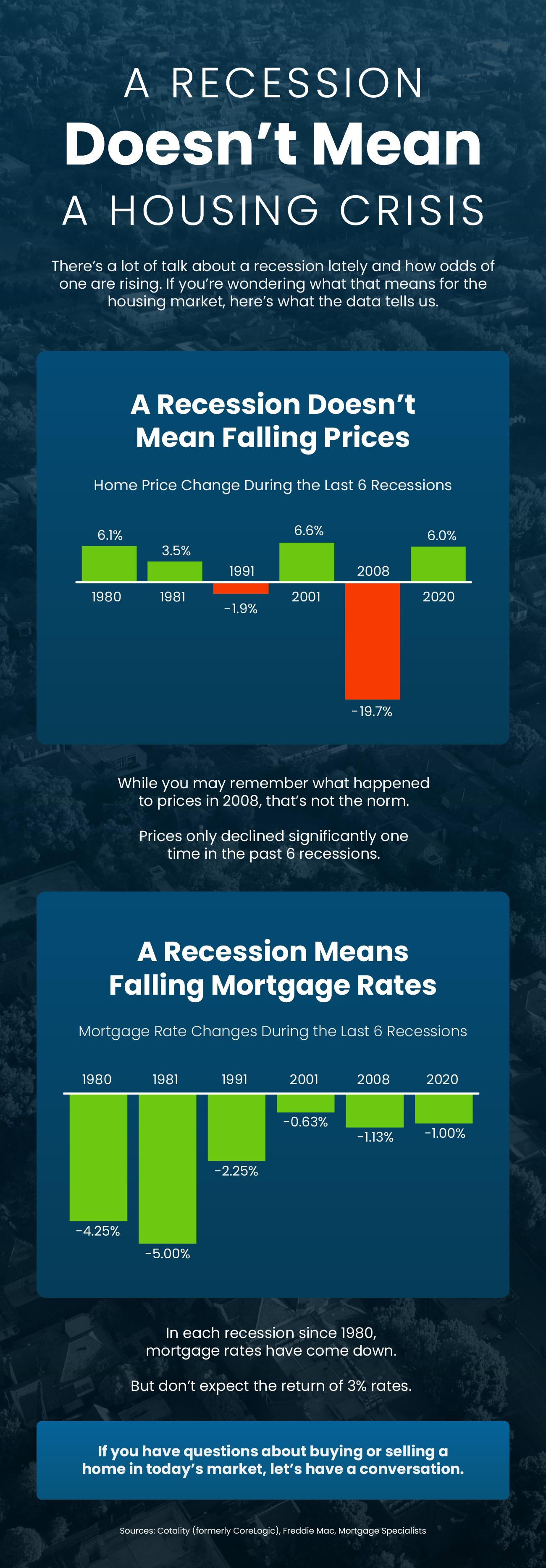

In fact, historical data shows that home values have remained stable—or even increased—during several past recessions. According to the National Association of Realtors (NAR), in four of the last six U.S. recessions, home prices actually appreciated. The exception was the 2008 housing crash, which was caused by risky lending practices and an oversupply of homes, not simply a weak economy.

Today’s Market Is Built on Stronger Foundations

The conditions that led to the 2008 crisis are not present in today’s housing market. Mortgage lending standards are significantly stricter, with most buyers required to meet rigorous income verification and credit criteria. Additionally, today’s homeowners typically have more equity in their homes, reducing the risk of widespread foreclosures.

Inventory levels also remain relatively low in many markets, which helps to support home prices even during economic slowdowns. This supply-and-demand balance is a key reason why housing values are more resilient today than they were in the past.

Why Housing Often Remains Strong During Recessions

Shelter is a basic necessity, and people continue to need places to live regardless of the economy’s status. While buyers may become more cautious, many still choose to move due to life changes such as marriage, job relocation, or retirement. In addition, lower interest rates—a common response by the Federal Reserve during recessions—can actually make home buying more attractive by improving affordability.

Renters may also consider purchasing during a recession to lock in a stable monthly payment and start building equity, especially if rental prices remain high.

What This Means for Buyers and Sellers

For buyers, a recession can present an opportunity. Interest rates often drop, giving them increased purchasing power. While some may wait on the sidelines, those who are prepared and pre-approved can take advantage of less competition and more favorable terms.

For sellers, it’s essential to understand that while buyer demand may moderate, homes that are well-priced and properly presented can still sell successfully. Working with a knowledgeable real estate professional can help sellers navigate pricing strategies and market trends with confidence.

The Bottom Line

A recession doesn’t automatically spell disaster for the housing market. Unlike the unique conditions of 2008, today’s real estate environment is healthier, more regulated, and better positioned to weather economic uncertainty. Whether you’re planning to buy, sell, or simply stay informed, understanding the true relationship between recessions and housing can help you make confident, informed decisions.

If you have questions about what the current market means for your real estate goals, we’re here to help.

EN

EN

ES

ES