In any market—whether real estate, consumer goods, or business deals—pricing is the linchpin of a successful sale. A compelling asking price doesn’t just attract buyers; it creates momentum, sparks interest, and closes deals. Conversely, an unappealing price can stall even the most desirable product or property, leaving sellers frustrated and buyers indifferent. Understanding why a compelling price is critical and how to set one can make the difference between a quick sale and a prolonged struggle.

The Psychology of Pricing

Buyers are driven by perceived value. A price that feels fair or advantageous triggers an emotional response, urging them to act. If the asking price seems too high, buyers disengage, assuming the seller is unrealistic or the item isn’t worth their time. Behavioral economics shows people compare prices to reference points—market trends, competitor offerings, or their own budgets. A price that aligns with or undercuts these benchmarks feels like a deal, even if it’s not a bargain in absolute terms.

For example, in real estate, a home priced slightly below market value often generates multiple offers, driving the final sale price higher through competition. Data from the National Association of Realtors indicates that homes priced within 5% of their market value sell 30% faster than those priced 10% or more above. A compelling price creates a sense of urgency, while an inflated one breeds skepticism.

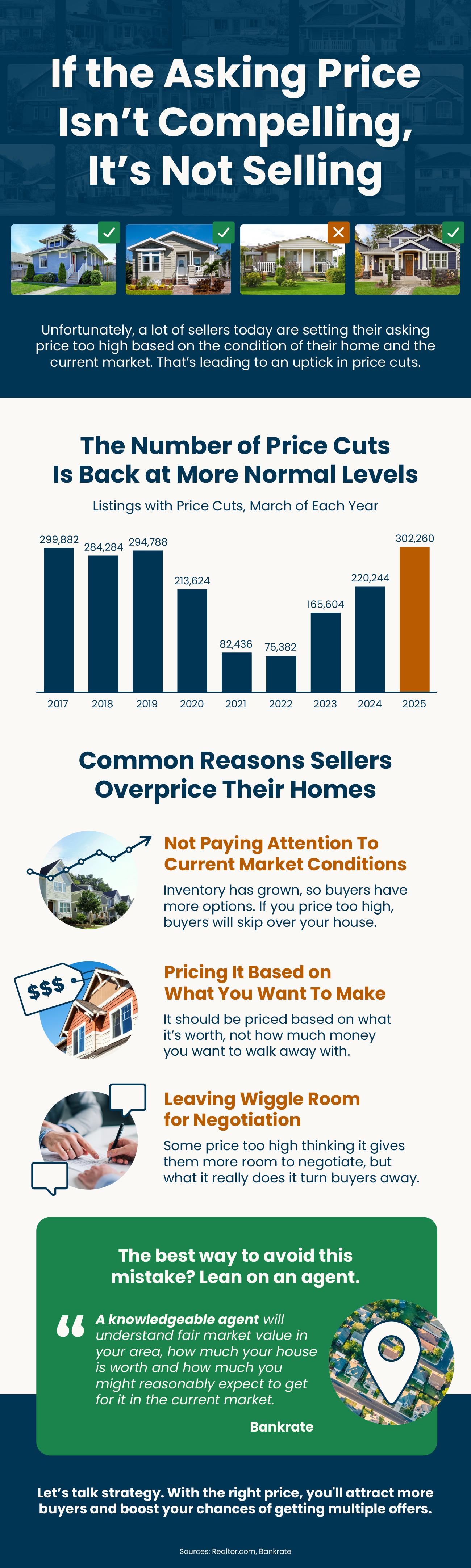

The Cost of Overpricing

An uncompetitive asking price doesn’t just slow sales; it can sabotage them entirely. In retail, products priced above competitors’ equivalents linger on shelves, forcing discounts that erode profit margins. A 2023 study by McKinsey found that 60% of consumers abandon purchases when prices exceed their perceived value by 15% or more. In business acquisitions, inflated valuations deter investors, who fear overpaying for assets that won’t deliver returns.

Overpricing also risks long-term damage. Listings that sit unsold for months—whether houses, cars, or businesses—develop a stigma. Buyers wonder, “What’s wrong with it?” In real estate, “days on market” is a critical metric; properties lingering past 60 days often sell for 5-10% less than their initial asking price, per Redfin data. The longer an item stays unsold, the more leverage shifts to buyers, who sense desperation.

Crafting a Compelling Price

Setting the right price requires research, not guesswork. Sellers must analyze comparable sales, market conditions, and buyer expectations. For instance, a used car seller should check Kelley Blue Book values and local listings to ensure their price aligns with similar models. In e-commerce, dynamic pricing tools can adjust rates in real-time based on competitor prices and demand.

Another strategy is psychological pricing—setting a price just below a round number, like $9.99 instead of $10. This tactic, rooted in cognitive bias, makes prices appear lower than they are. Additionally, offering incentives, like free shipping or a bundled service, can enhance perceived value without slashing the price.

Market Context Matters

A compelling price isn’t static; it depends on the market’s temperature. In a seller’s market, where demand outstrips supply, prices can edge higher without losing appeal. In a buyer’s market, aggressive underpricing may be necessary to stand out. During economic uncertainty, such as the 2020 pandemic, flexible pricing helped businesses clear inventory, while rigid pricing led to losses.

Ultimately, a compelling asking price is one that resonates with buyers, aligns with market realities, and reflects the item’s value. Sellers who prioritize research and adaptability sell faster and profit more. Those who cling to unrealistic prices risk watching their assets gather dust, proving the hard truth: if the price isn’t compelling, it’s not selling.

BOTTOM LINE

A compelling asking price is the cornerstone of any successful sale, whether in real estate, retail, or business deals. It’s not just a number—it’s a signal that captures buyer attention, conveys value, and drives action. Prices that align with market trends and buyer expectations create urgency and competition, often leading to faster sales and better outcomes. Conversely, an uncompetitive price repels buyers, prolongs the selling process, and risks stigmatizing the item as undesirable. Data underscores this: homes priced within 5% of market value sell 30% faster, while overpriced goods can linger, forcing discounts that cut profits.

Crafting the right price demands diligence. Sellers must research comparable sales, monitor market dynamics, and consider psychological tactics like pricing just below round numbers. Flexibility is key—adapting to buyer or seller market conditions ensures relevance. Incentives, such as free shipping or bundled services, can further sweeten the deal without lowering the price. The cost of mispricing is steep: extended days on market, diminished buyer trust, and reduced leverage. Ultimately, a compelling price reflects a seller’s understanding of their audience and the economic landscape. By prioritizing strategic pricing over wishful thinking, sellers unlock the potential for swift, profitable transactions. The lesson is clear: if the asking price doesn’t resonate, the sale won’t happen.

EN

EN

ES

ES