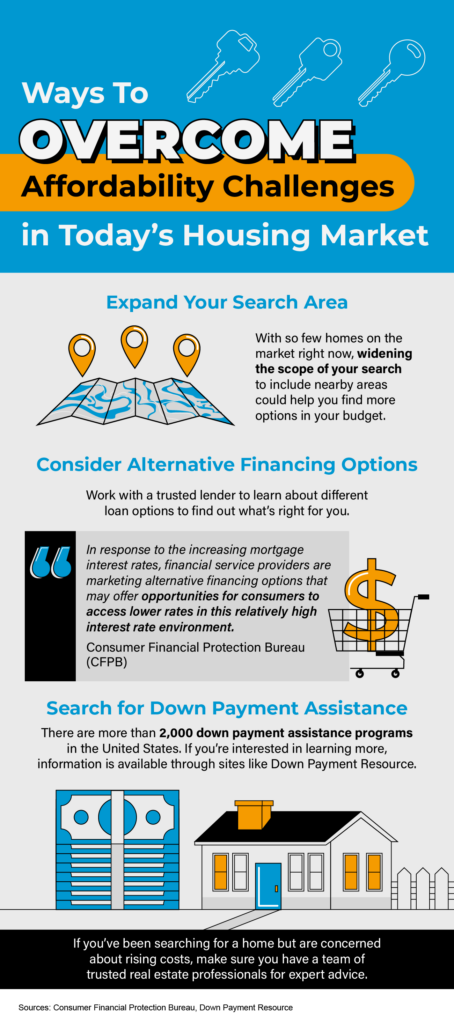

Ways to Overcome Affordability Challenges in Today’s Housing Market

The dream of homeownership seems more elusive than ever in today’s housing market. Escalating property prices, coupled with economic uncertainties, have created significant affordability challenges for prospective buyers. However, hope is not lost. With careful planning, creative solutions, and perseverance, individuals can still make their homeownership aspirations a reality. In this blog, we will explore six effective ways to overcome affordability challenges and secure a place to call your own in the current housing market.

Educate Yourself Financially:

Before diving into the housing market, equip yourself with sound financial knowledge. Understand the intricacies of mortgages, interest rates, and other financing options available. Develop a budget to analyze your income, expenses, and potential savings for homeownership. Taking time to educate yourself about the financial aspects of purchasing a home will empower you to make informed decisions.

Explore First-Time Homebuyer Programs:

Many local and national governments offer first-time homebuyer programs designed to assist individuals in entering the housing market. These programs may include down payment assistance, low-interest loans, or tax credits. Research and identify the programs available in your area and determine if you qualify for any of them. These initiatives can significantly ease the financial burden of purchasing a home.

Consider Shared Equity Arrangements:

Shared equity arrangements have gained popularity as an innovative solution to housing affordability challenges. In such partnerships, multiple parties pool their resources to purchase a property jointly. This not only reduces the financial burden but also allows for shared responsibilities and rewards of homeownership. Collaborate with friends or family members who share the same goal, or explore shared equity programs offered by housing organizations.

Look Beyond the Traditional Market:

Broaden your search horizons and consider alternative housing options. Tiny homes, manufactured houses, and modular homes are gaining traction as more affordable alternatives to traditional single-family homes. Additionally, exploring cooperative housing or community land trusts can provide unique opportunities for homeownership at reduced costs.

Improve Your Credit Score:

A higher credit score can open doors to better financing options and lower interest rates. Before applying for a mortgage, review your credit report, and work towards improving your score. Paying off outstanding debts, ensuring timely bill payments, and reducing credit card balances can positively impact your creditworthiness and enhance your chances of securing a more affordable mortgage.

Be Patient and Flexible:

The current housing market can be competitive and fast-paced, but patience and flexibility are key virtues. Avoid rushing into a purchase that might stretch your budget to its limits. Instead, be open to considering homes in transitioning neighborhoods or waiting for the right opportunity. Negotiate with sellers and explore the potential for seller concessions or price reductions.

BOTTOM LINE

While affordability challenges persist in today’s housing market, proactive strategies and creative thinking can help you overcome these obstacles. By educating yourself financially, exploring assistance programs, considering shared equity arrangements, exploring alternative housing options, improving your credit score, and practicing patience, you can inch closer to the dream of homeownership. Remember that perseverance and determination are essential in navigating the storm of the current housing market. With careful planning and the right approach, your dream of owning a home can become a reality. Let’s Connect today!

EN

EN

ES

ES